NEWS

HOME > NEWS

Steel-producing nations have recovered from the slump in production caused by the Covid-19 pandemic – with two major exceptions.

![]()

The latest information released by the World Steel Association (worldsteel) indicates that 2021 global crude steel output rose by 3.7 percent, year-on-year, to an all-time high of 1.95 billion tonnes.

Steelmakers in the European Union (EU) manufactured 152.5 million tonnes, in 2021 – a rise of more than 15 percent, compared with the 2020 outturn.

German steel mills got back on track, producing over 40 million tonnes, in 2021. This was the first time in three years that annual output had grown. Blast furnace production had been hardest hit by the coronavirus outbreak, with manufacturers unable to respond to the rapid change in demand.

The recovery in Italian output was supported by the refiring of several blast furnaces at the long-troubled Ilva plant – one of Europe’s largest steel-producing facilities – in the first quarter of 2021. This helped Italy’s output to rise by 20 percent when compared with the figure recorded in the previous year.

Other European countries, outside the EU, also fared well in 2021. Their combined output of 51.2 million tonnes represented an increase of 11.6 percent, year-on-year.

US mills post record profits

Steelmakers in the United States also performed admirably, producing 86 million tonnes of crude steel, in 2021. Increased demand, following the easing of Covid restrictions and announcements of major federal infrastructure spending projects, led to record steel prices in the country. Consequently, many top steelmakers were able to post record annual profits. Several new capacity projects have been announced in the United States. The majority of these will be powered by electric arc furnaces.

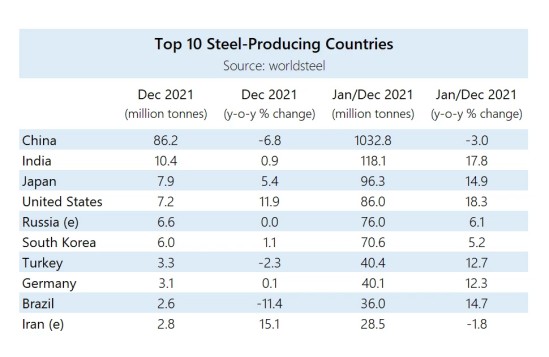

Overall, production rose in eight of the ten largest steel producing nations, in 2021. Only China and Iran produced less than in the previous year. Of these eight countries, four – India, Russia, Turkey, and Brazil – enjoyed record-breaking years, producing more steel than at any time in their history. Combined, these four countries produced over 270 million tonnes of steel – approximately 14 percent of the global total.

The phenomenal growth in steel production seen in Southeast Asia has also continued apace. Annual output in the region has more than doubled over the past five years and now totals more than 49 million tonnes.

China bucks the trend

However, melting activity in China, the world’s largest steel producer by volume, did not follow this general trend. While output recovered strongly in the first half of 2021, production restrictions, enforced by local officials, became increasingly stringent as the year progressed.

This was largely due to the change in priorities, to focus on growth through increased domestic consumption, as highlighted in the country’s latest Five-Year Plan. China’s desire to reduce environmental emissions, ahead of its hosting of the Winter Olympics, in 2022, was also a key factor. As a result, China’s total crude steel production declined by 3 percent, year-on-year, to 1.03 billion tonnes – marking the first drop in output since 2015.

MEPS’ latest five-year production forecasts – as included in our recent Steel Price Outlook publication – suggest that, while this contraction in output will be transitory, the era of record growth, seen previously, may be over. Chinese output is expected to climb at a much lower rate than in recent years – rising approximately one percent per year before tapering off at close to 1.065 billion tonnes, from 2024.

Construction of new steelworks will continue to be a regular occurrence in China. However, due to the restrictions involved in the capacity replacement programme, any new mills brought online must be offset by the closure of older, heavier-polluting production facilities. This means the ratio of steel produced by electric arc furnaces will increase in China over the coming years.

What happens next?

Capacity expansion projects are progressing in various countries around the world. OECD figures suggest that over 45 million tonnes of new capacity is due to come online between 2021 and 2023. Another 69 million tonnes is currently in the planning phase.

MEPS expects that global crude steel output will continue to rise over the next five-year period. Total output is likely to reach 2.06 billion tonnes, by 2026. We anticipate that much of this growth will occur in Asia and the Middle East, with India accounting for one quarter of the additional tonnage.